Global Tax and Bank Crypto Rules Update: OECD’s CARF, EU Implementation & U.S. Bank Shifts

- BlocBerg

- Jun 12

- 3 min read

As the cryptocurrency industry continues its integration into mainstream finance, regulators around the world are rapidly developing new frameworks to govern tax compliance and banking standards. Among the most significant recent developments are the OECD’s Crypto‑Asset Reporting Framework (CARF), the European Union’s adoption of that standard, and an evolving stance by U.S. banks towards offering crypto-related services.

This article breaks down what these global regulatory shifts mean for the future of crypto compliance, privacy, and adoption.

OECD’s Crypto‑Asset Reporting Framework (CARF): A New Global Standard

The Organisation for Economic Co-operation and Development (OECD) introduced CARF to bring transparency to digital assets. This standardized framework will require crypto service providers—including exchanges, wallet providers, and brokers—to collect and report detailed information about users, including:

Taxpayer Identification Numbers (TINs)

Personal identifying data (e.g., name, address, birth date)

Transaction type and volume

Cross-border transfers

This data will be automatically shared with relevant tax authorities under agreements modeled on the Common Reporting Standard (CRS) used for traditional finance. EU Adoption Begins in 2026

According to Yahoo Finance, the European Union has confirmed its January 1, 2026 deadline to implement CARF, making it a legal requirement for crypto platforms operating within the EU. Firms that fail to comply may face steep penalties or be barred from operating within member states.

This aligns with the EU’s broader MiCA (Markets in Crypto-Assets) regulation, which enforces licensing and consumer protection obligations across the crypto sector. U.S. Response: Potential Alignment, Plus a Changing Bank Landscape

Will the U.S. Adopt CARF?

Although the U.S. has not officially committed to adopting CARF, discussions within Congress and the IRS suggest alignment is likely. The IRS has already expanded its definition of digital assets for tax reporting purposes, and bipartisan lawmakers have expressed support for greater global tax coordination.

In an Axios newsletter on digital finance, analysts speculated that Treasury officials are quietly exploring how CARF could be aligned with existing FATCA obligations and the forthcoming IRS Form 1099-DA rules for digital assets. U.S. Banks Embrace Crypto – Slowly but Surely

While crypto regulation tightens globally, U.S. banks are beginning to ease internal restrictions and offer services such as:

Crypto custody

Crypto-backed loans

Blockchain integration for B2B transfers

Wealth management products involving Bitcoin ETFs

Major players like JPMorgan Chase, Bank of America, and Citibank are expanding teams focused on blockchain research and pilot programs, in part due to increasing customer demand and regulatory clarity. Michigan Moves in the Opposite Direction

Not all U.S. states are on the same page. In Michigan, regulators have taken a more cautious stance, issuing guidance that tightens rules on state-chartered banks offering crypto services. This includes:

Requiring pre-approval before engaging in any digital asset operations

Establishing minimum capital requirements

Mandatory consumer disclosure and risk assessments

As reported by Blockpass, these rules are part of a broader movement among states (like New York and Hawaii) that view digital assets as high-risk financial instruments requiring stricter oversight. The Global Picture: Coordinated, Yet Fragmented

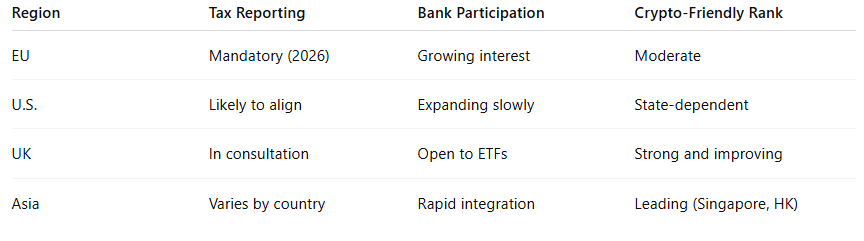

While CARF marks a step toward unified global tax reporting, the overall regulatory landscape remains fragmented:

What Experts Are Saying

“CARF represents a pivotal moment for crypto. It's the beginning of the end of the anonymity era for digital assets.”— André Martins, Tax Compliance Officer at Blockpass

“Regulators are finally treating crypto like a real financial asset class. That means greater trust and broader adoption—eventually.”— Sarah Pritchard, Deputy CEO of the UK Financial Conduct Authority

What This Means for Crypto Users & Businesses

For Users:

Expect more KYC/AML procedures when opening crypto accounts

Tax reporting obligations will become automatic and international

Reduced privacy in crypto unless using privacy-preserving tech

For Businesses:

Must integrate CARF-compliant tools (like smart tax reporting platforms)

Need to assess jurisdictional risks (especially in the U.S. and EU)

Likely benefit from institutional credibility and bank partnerships

Final Thoughts

The global shift toward tax transparency and banking standardization is a double-edged sword. On one hand, it promises legitimacy, broader adoption, and integration with legacy finance. On the other, it raises valid concerns about privacy, overreach, and regulatory overhang—especially for crypto natives who value decentralization.

As the OECD’s CARF rolls out in the EU and the U.S. banks cautiously re-enter the crypto space, a new regulatory era begins—one where compliance is no longer optional, but foundational.

Comments